Hi! Welcome back to another month-end net worth update.

A few things to note before we delve into the net worth update:

- I’m from Singapore. Therefore, I will be tracking my net worth in Singapore Dollars. In short, “S$”.

- However, for the benefit of readers who are more familiar with the currency of US Dollars, I’ve also included a simple conversion from S$ to US$ at certain parts of my net worth update.

- At the time of writing this post, the exchange rate of Singapore Dollars to US Dollars is S$1 to US$0.707. Conversely, US$1 is equal to S$1.415.

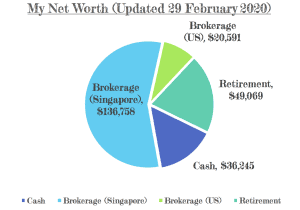

Let’s start off with an overview of my entire net worth.

For those following the stock markets, you might be wondering how I managed to end February 2020 with a large increase in net worth despite the bloodbath in the markets.

There’s a very simple explanation for that – Because I had not been absolutely thorough in my accounts keeping, I had been reporting an understatement of my net worth over the past year. (I’m sorry!)

- My girlfriend and I share a joint account, and I realise that I had been contributing much more than she was, although we split our assets down the middle. This was my fault, as I was the one in control of our joint account, and didn’t realise that I had been trigger happy buying shares (and contributing the money for it). After working out the math, I had my girlfriend transfer across almost $10,000 of cash to our joint account to account for the difference in contributions. That added a bunch to my net worth.

- In addition, I went through my safe and found that I had under-reported the cash I held in there by more than $1,500. I added this to my net worth as well.

- The biggest dividend pay-out by our Singapore portfolio is usually received in February, with the rest being paid out in smaller amounts throughout the rest of the year. This also added to my net worth.

- There was also Chinese New Year, in end of January, and I cashed in the money in February.

- Last but not least, I had income from my corporate job.

All of this added a significant amount of money to my net worth.

As a result of the steep decrease in the markets, I also invested a bunch of this cash to both my Singapore and U.S. portfolio. This resulted in the increases in both portfolios as well.

Another reason why I managed to report an increase in net worth is because the value of my bonds had increased by a fairly significant amount, while my stocks were falling.

If you’re looking for more details of my net worth, here they are. 🙂

Brokerage Accounts

Singapore Portfolio

Bond Index ETF – S$44,116

Stock Index ETF – S$84,560

Individual Shares – S$8,082

Total – S$136,758 (US$96,688)

United States Portfolio

Stock Index ETF – US$11,549

Individual Shares – US$3,003

Total – S$20,591 (US$14,552)

Cash in Bank Accounts

Brokerage Account 1 – S$2,836

Brokerage Account 2 – S$1,280

Bank Account 1 – S$17,000

Bank Account 2 – S$500

Bank Account 3 – S$10,472

Bank Account 4 – S$504

Cash on Hand – S$3,653

Total – S$36,245 (US$25,625)

Retirement Accounts

Retirement Account 1 – S$30,415

Retirement Account 2 – S$8,548

Retirement Account 3 – S$10,106

Total – S$49,069 (US$34,692)

And that’s it!

I hope to improve on these net worth updates over the months, in content and in form. Hope you stick around for that 🙂

Thanks for reading!

Love,

Liz

0 Comments